KEEP OUR COUNTRY MOVING AND MAKE YOUR KENWORTH DREAM A REALITY

The Federal Government has announced measures to boost the economy. There are several parts to the stimulus package, one of which is directly related to buying a Kenworth. Now is the time to make your Kenworth dream a reality!

Who is eligible and how do these incentives work?

Businesses with aggregated turnover of less than $500m.

How does the Government’s stimulus package mean I can buy a Kenworth?

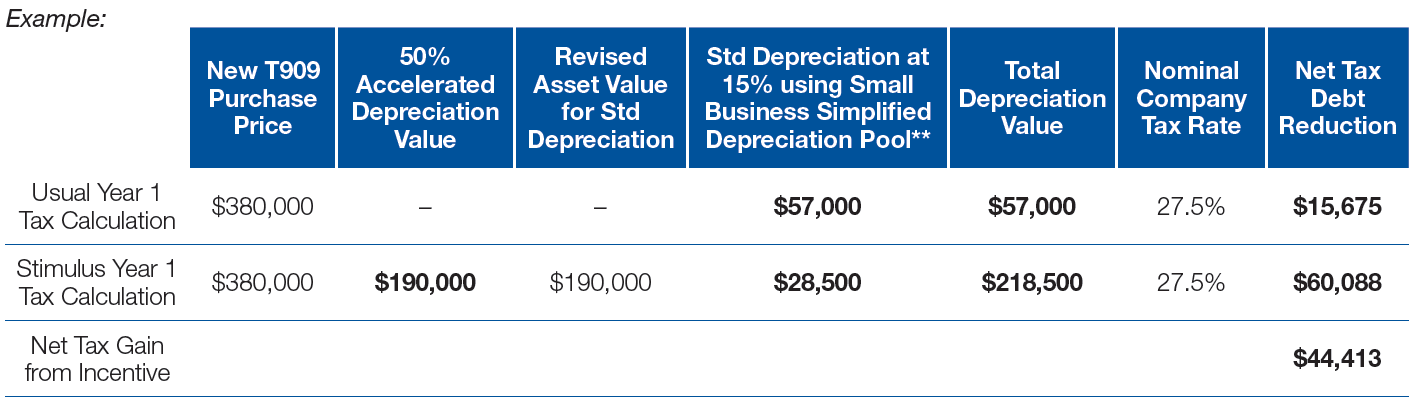

The Business Investment Incentive is a temporary business investment allowance for eligible businesses to purchase new trucks. The new truck needs to have been acquired after 12 March 2020 and first used or installed by 30 June 2021. This will allow businesses an additional 50% accelerated depreciation deduction in the first year.#

Contact your local Kenworth dealer to get a quote now!

This should not be considered as tax advice. Please seek your own independent advice to determine eligibility and talk to your financial advisor.

# Assets that are eligible include new trucks that can be depreciated under Division 40 of the Income Tax Assessment Act 1997. Normal depreciation schedules apply after year one.

** This is an example only. Consult professional financial advice for selecting the appropriate depreciation model.